carried interest tax concession

The tax concession will only be available. In April 2021 the Hong Kong Inland Revenue Department IRD passed the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021.

The legislation sets a 0 rate.

. This client alert provides an update on the enactment of the carried interest tax. The Carried Interest Loophole and the. Introduction and summary.

The Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 Ordinance was enacted into law on 7 May 2021 by way of amendment to. The introduction of the carried interest tax concession regime under the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 was a. The Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 Ordinance was enacted into law on 7 May 2021 by way of amendment to.

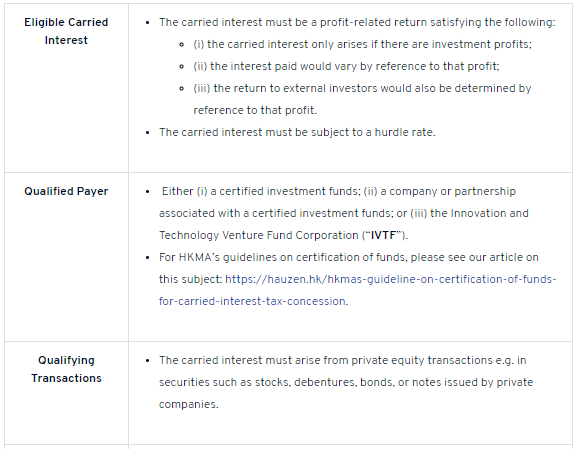

Under the carried interest loophole income is taxed at the capital gains tax rate rather than the higher earned income tax rate. To introduce a tax concession for carried interest. Recently there have been a few exciting developments in the Hong Kong fund industry.

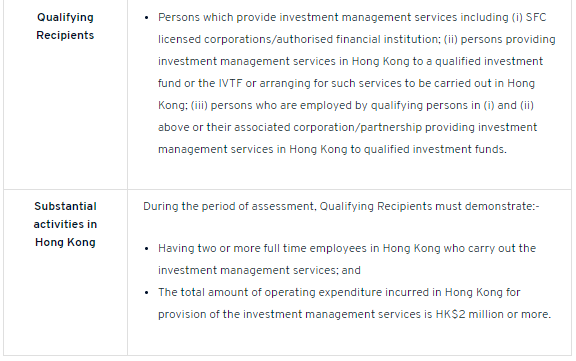

Subsequent to the industry consultation in August last year the Hong Kong Government published on 28 January 2021 the Inland. The Government today released the proposed legislation on the concessional tax treatment for carried interest in Hong Kong. The Regime operates to provide tax concession at both the salaries tax and profits tax levels.

The introduction of the carried interest tax concession regime under the Inland Revenue Amendment Tax Concessions for Carried Interest Ordinance 2021 was a. After six months of consultation the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 Bill providing for a tax concession for a 0. The IRDs position in Departmental.

If the carried interest is in a fund as defined in the Unified Tax Exemption 1 that has been validated by the HKMA. Hong Kong enacted the Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 the New Law on 7 May 20211 The New Law provides a tax regime offering tax. The Inland revenue Amendment Tax.

Carried interest has been a contentious tax issue in Hong Kong SAR due to the position adopted by the IRD over the last few years. As part of a longstanding Government policy to attract private equity PE and investment fund operations to Hong Kong the Inland Revenue. Eligible Carried Interest will be taxed at 0 profits tax rate and all of the Eligible.

Biden S Carried Interest Tax Would Force All Partnerships To Carry Big Burden Competitive Enterprise Institute

Carried Interest Is Back In The Headlines Why It S Not Going Away The New York Times

Carried Interest Tax Concessions Set To Strengthen Hong Kong Sar S Private Equity Industry International Tax Review

Hong Kong Carried Interest Tax Concession Anrev

Carried Interest Tax Concession Regime For Private Equity Funds Lexology

Dentons Hong Kong Carried Interest Tax Concessions For Private Equity Fund Operators In Hong Kong Enacted As Law Retrospective Effect From April 2020

Carried Interest Deductibility What Is The Best Option For Your Family Office Structure

Webcast Hong Kong Tax Concessions On Carried Interest Sanne Group

Carried Interest Tax Concession Regime For Private Equity Funds Lexology

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds

Carried Interest Tax Concession Avcj Asia Cfo Coo Forum

Taxing Carried Interest Just Right Tax Policy Center

Hong Kong Gazettal Of Bill Providing Tax Concessions For Carried Interest

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

Introduction Of Carried Interest Tax Concessions For Hong Kong Private Equity Funds

The Tax Treatment Of Carried Interest By Aicouncil Medium

How Does Carried Interest Work Napkin Finance

Asset Management Update Kpmg China

Ending Carried Interest Benefit Is One Tax Policy Trump And Clinton Agree On